Direct reimbursements in just a few clicks

Save time by streamlining how you pay your employees back. Use Pleo to easily approve and process reimbursements in less than 24 hours or empower your employees to reimburse themselves.

Powered in the UK by B4B partnership

Leading expenses tool in Europe

2000+ five star reviews

Works with all accounting systems

50+ app integrations

Reimbursements made simple for you and your employees

Streamline your reimbursements, whether out-of-pocket, mileage or per diem. Use Pleo to pay your people back in the way that’s right for your business, whilst keeping all types of expenses in one single solution.

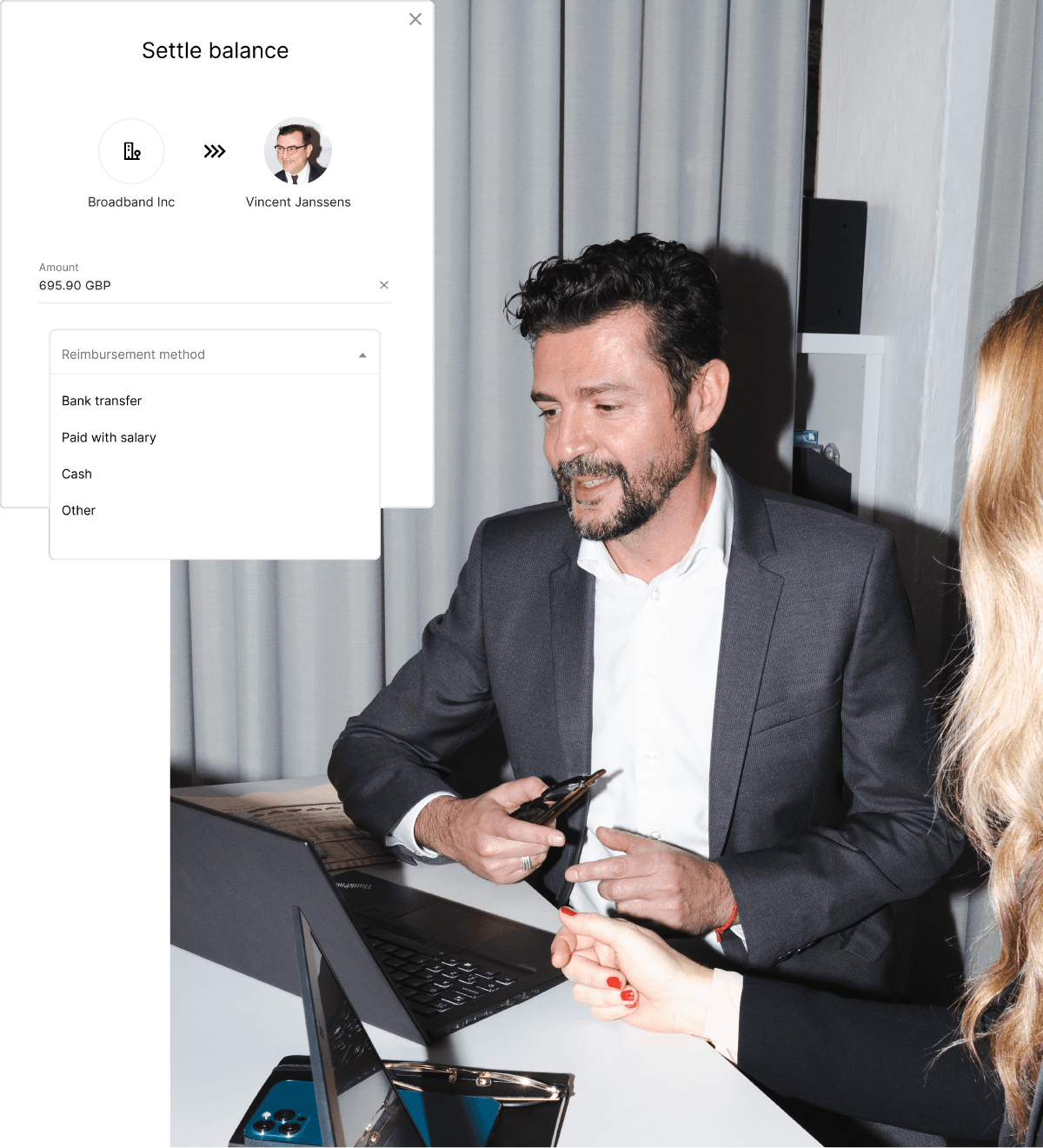

Be in control of how and when you pay back

Let your employees reimburse themselves or let finance teams initiate the repayment process at a time that’s best for your cashflow.

![]()

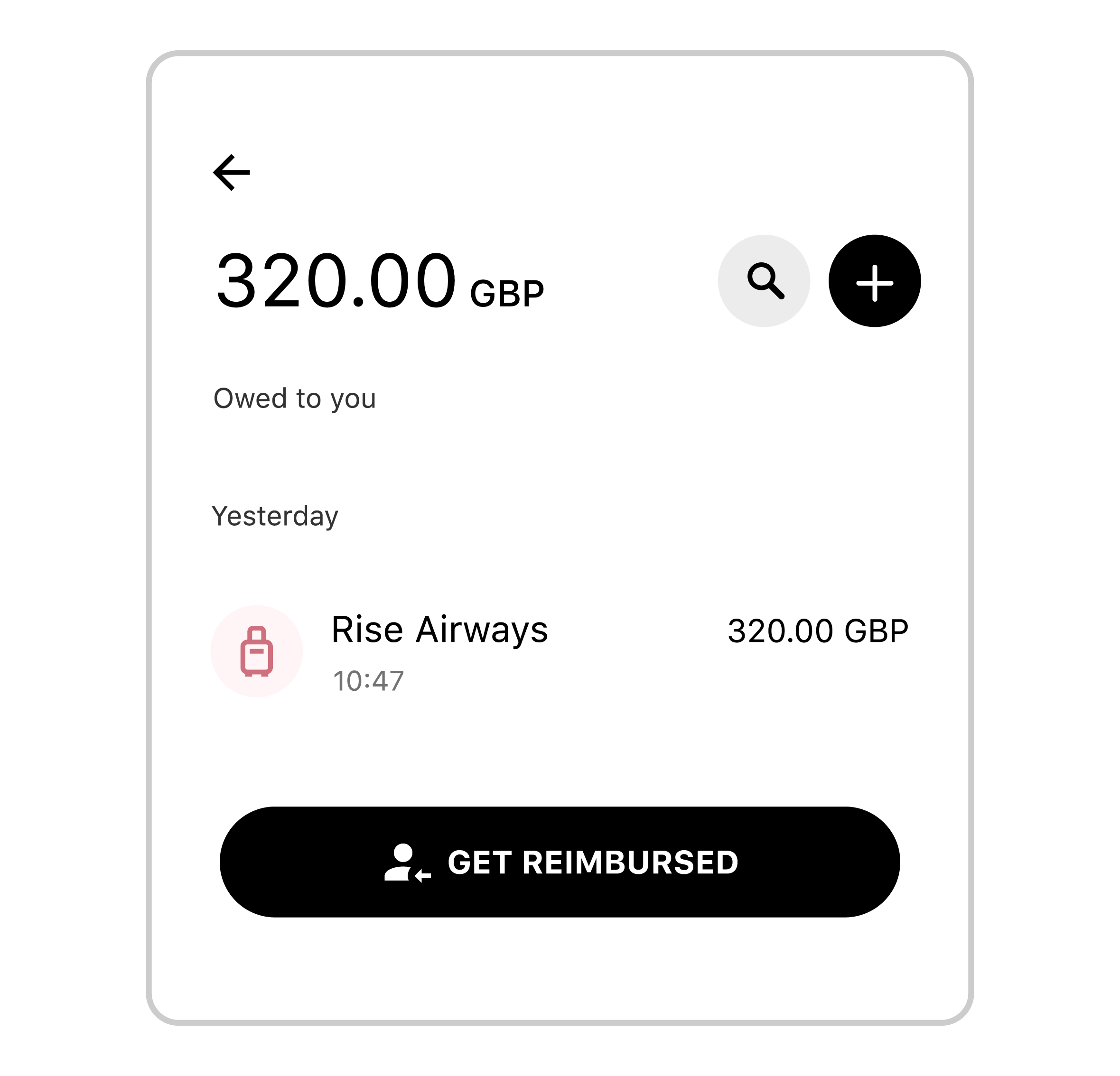

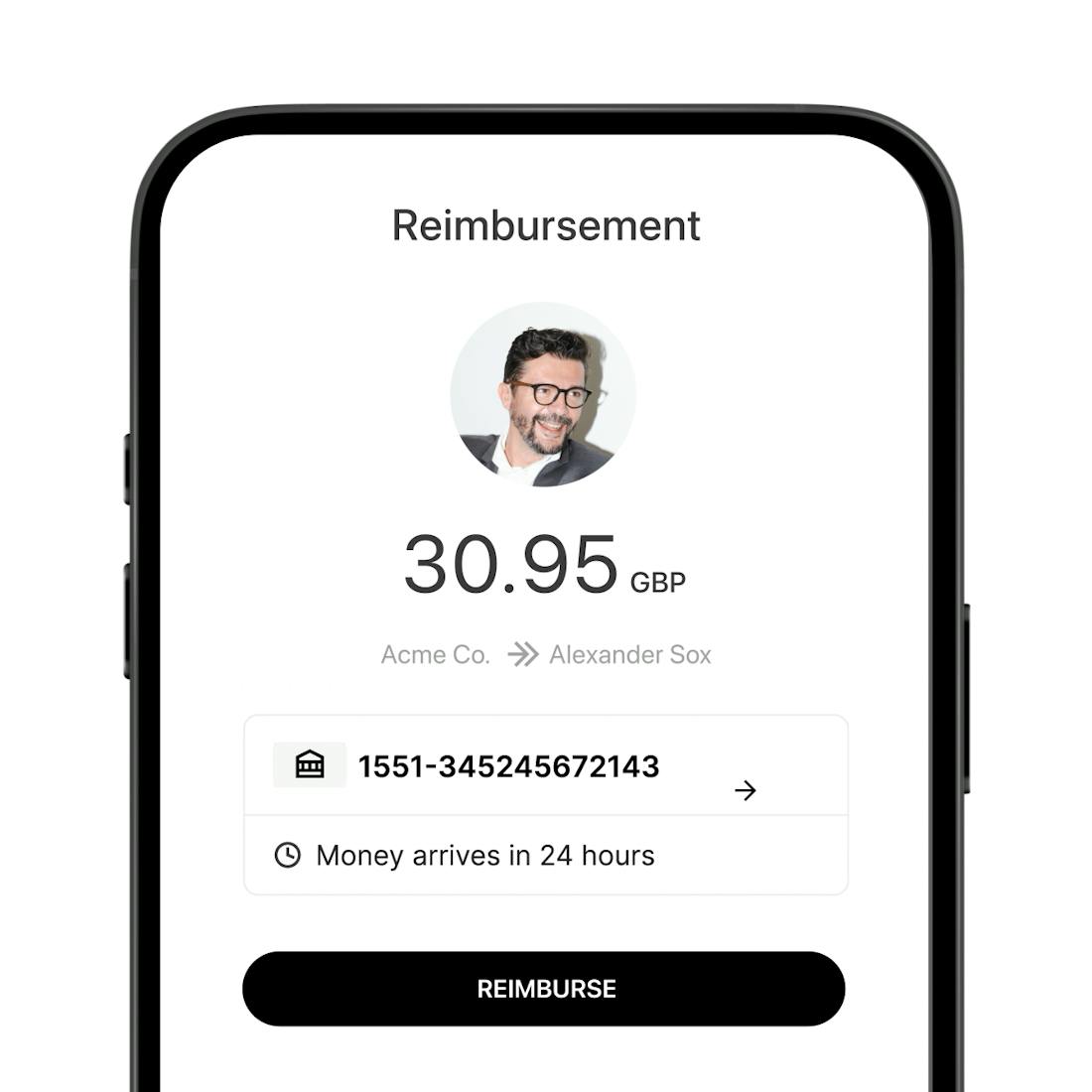

Autonomy for your employees

Reimburse your employees quickly and transparently. With a few clicks, they’ll receive their money back – whether they’re frequent spenders or not.

![]()

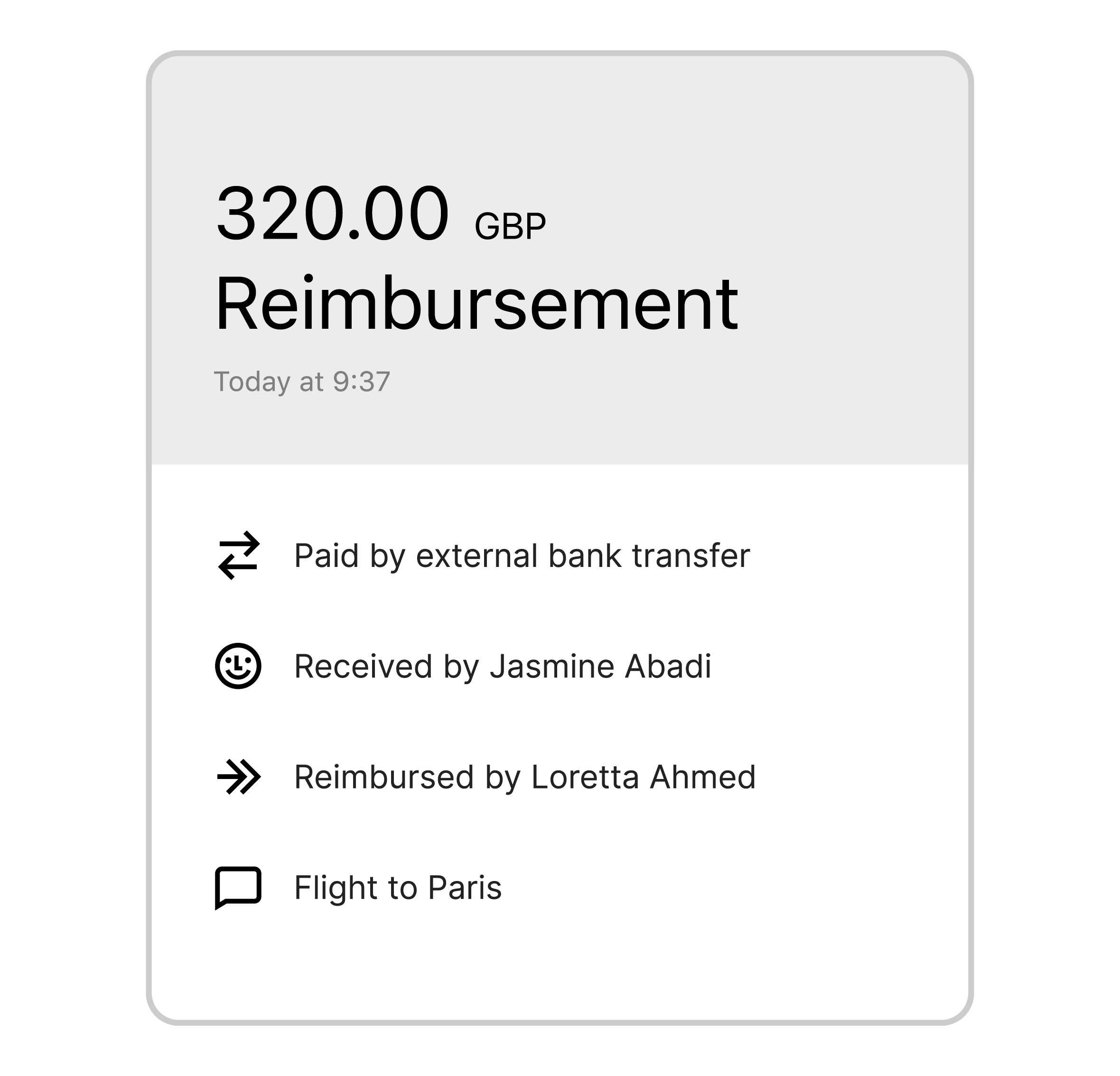

An automated experience

With reimbursements, you can repay with ease. Let finance teams process expense claims at a time best suited for the business or empower employees to reclaim themselves – putting you in control of when and how your team gets paid back.

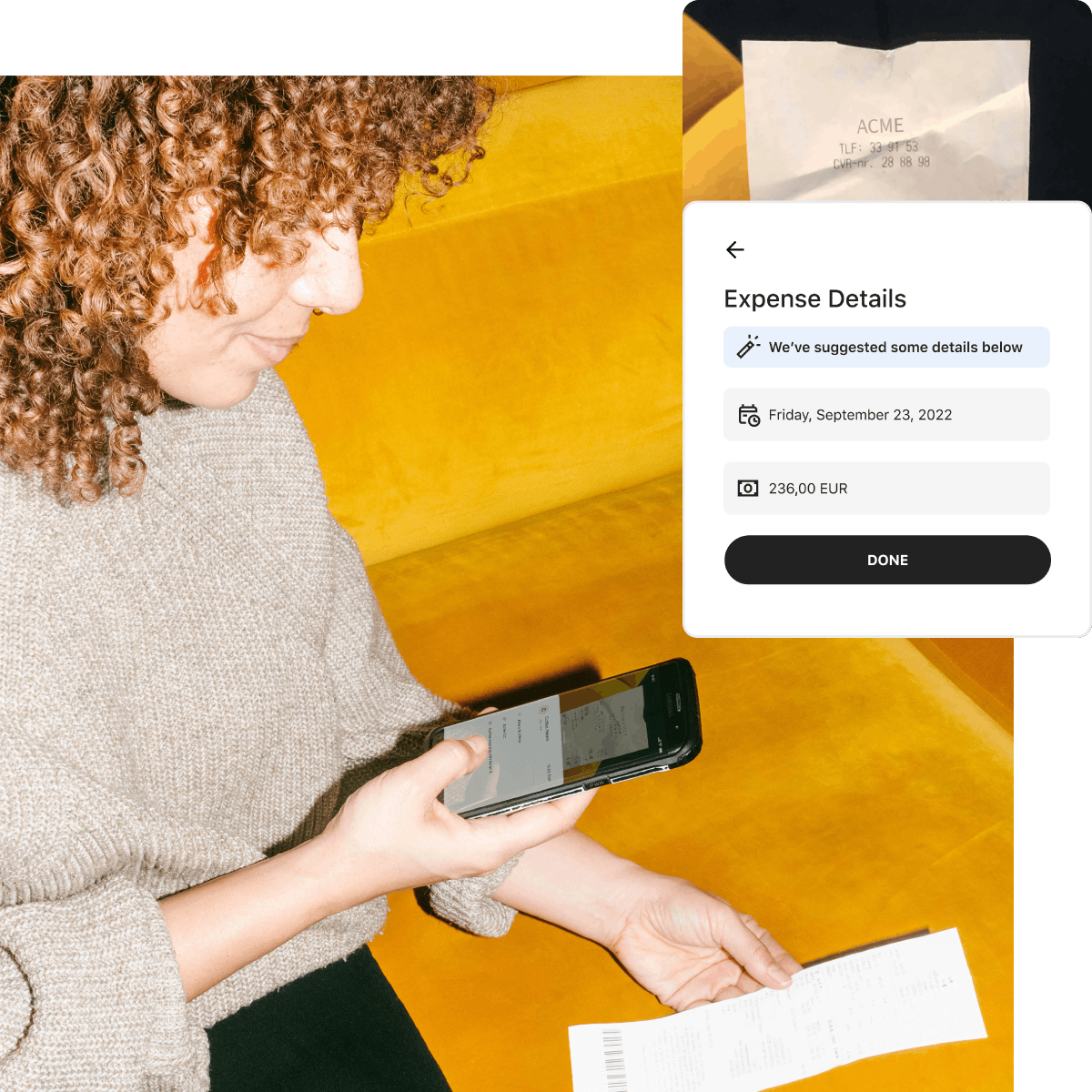

Manual errors? Not here - Eliminate manual mistakes

Usually, employees have to manually add the details of their expense claims, leaving room for human error. With Pleo, OCR technology scans each receipt to ensure that each detail your finance team sees is correct, from the date and amount to the merchant.

Bookkeeping made simple

Whether your employees are buying office materials, sandwiches, coffees, petrol, car rentals – or you name it, we’ll help you repay it. Having full visibility of a streamlined reimbursement process makes bookkeeping simple.

"We handle our entire reimbursement process through Pleo. We have a learning budget available, so a lot of our team members use it to buy books and courses and then get swiftly reimbursed through Pleo."

Faith Metobo Senior Finance Manager, Blinkist

![]()

"With Pleo, I know that my team is using minutes a month to book all the expense entries instead of hours, and then they can move on to a new, more useful task."

Martin Dalskov Accounting Manager, Podimo

![]()

"I would recommend Pleo to every company that wants to save time."

Leonard Bergström Nordic Operations Manager, Budbee

![Portrait of Leonard Bergström and Budbee logo]()

Tailor our offering to match your needs

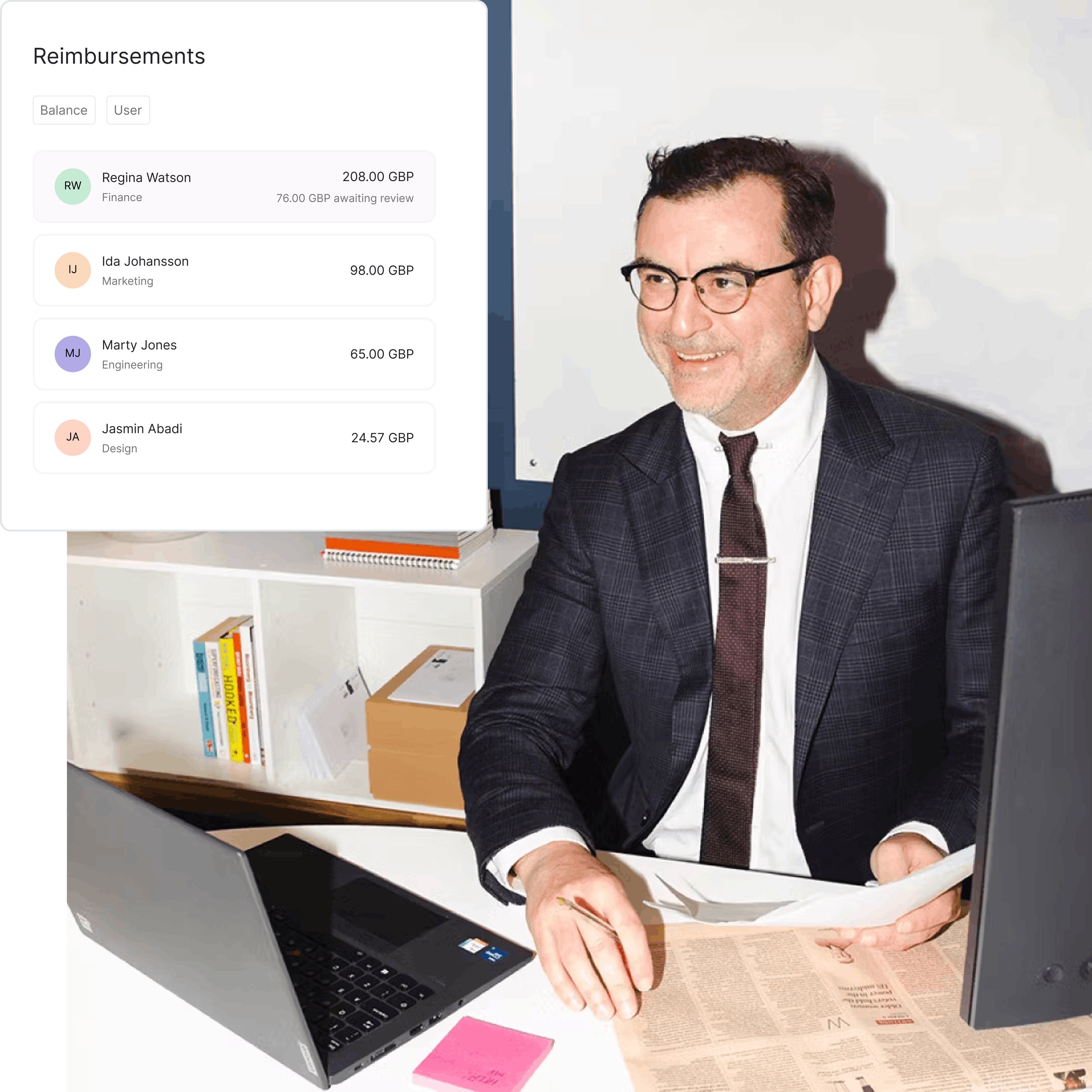

For full flexibility, our reimbursements feature caters to a variety of spending needs, and supports the management of all of your employees and their reimbursements in the same space.

Frequent spenders with Pleo cards

Even Pleo card users may need to dip into their own pockets from time to time. Keep all receipts in one place by giving them access to direct reimbursements. They can simply snap a picture in the Pleo app and get repaid with a few clicks.

Infrequent spenders without Pleo cards

When we say keep all receipts in one place, we mean it. Even employees who don’t need a Pleo card can be invited to do their reimbursements in the Pleo app. And it’s the same drill: Snap a picture, and get repaid.

Without Pleo

Outstanding repayments can cause havoc when it comes to bookkeeping, and not knowing who's spent what and when creates chaos come end-of-month.

![]()

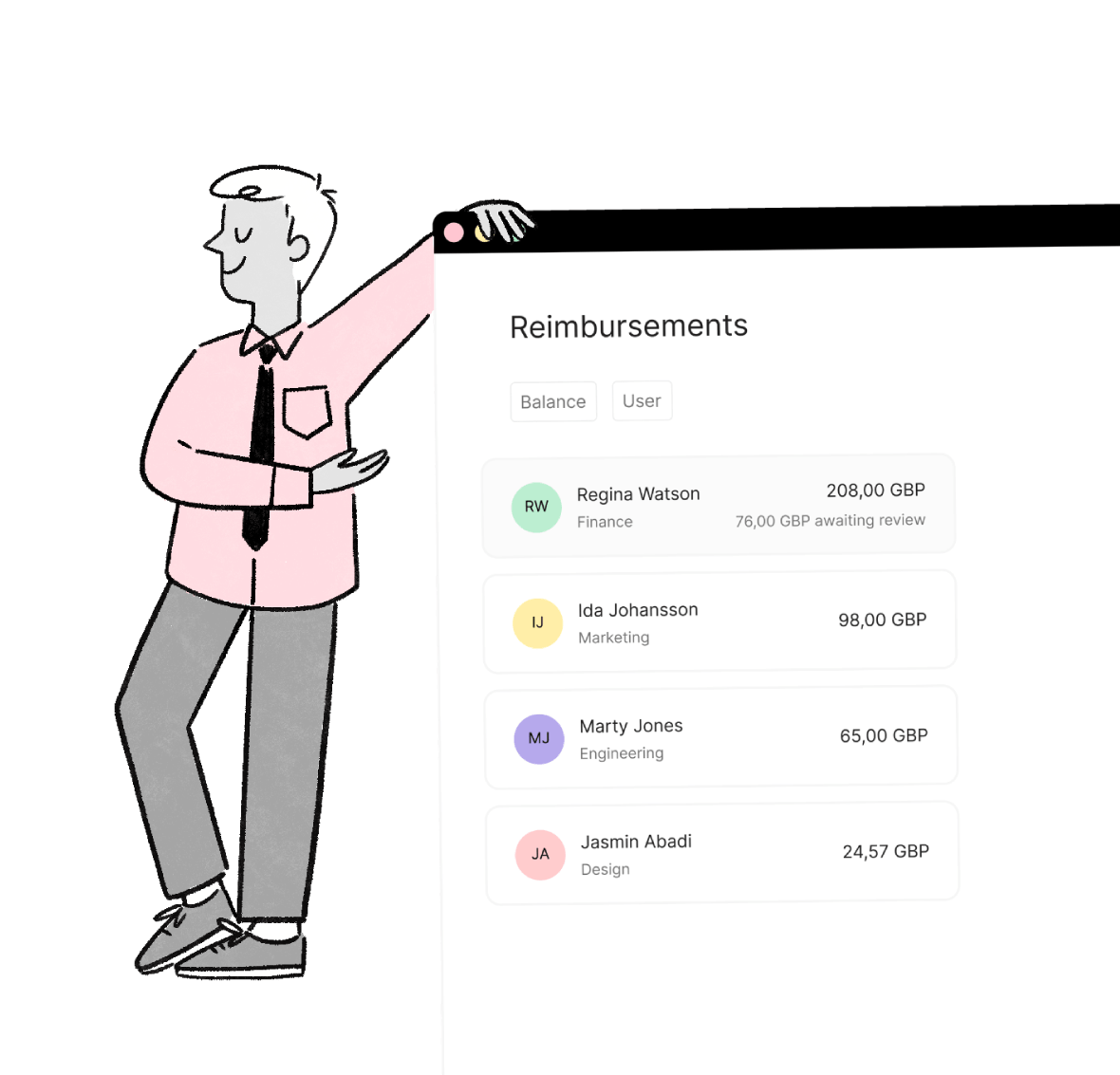

With Pleo

Get a clear view of all the money owed to your team. Let employees reimburse themselves or allow finance team to trigger repayments, so you're always on top of your cash flow.

![]()

A little more detail

When an employee has bought something with their own money, they can easily add the expense to the Pleo app. Pleo allows for approval workflows, be that team leads or finance, so reimbursements require signing off. Whether you opt for admin-initiated (AIDR) or employee-initiated direct reimbursements (EIDR), once a reimbursement has been approved, the employee will receive a notification letting them know the amount has been transferred to them – just make sure the employee has added their bank account details beforehand. The expense plus reimbursement is tracked and recorded in the platform, just like a purchase made with a Pleo card.