The virtual card that your business deserves

Ready to try a spending solution that can’t be lost or stolen? Pleo’s virtual cards are simple, secure and trackable.

Powered in the UK by B4B partnership

Better than plastic? Maybe

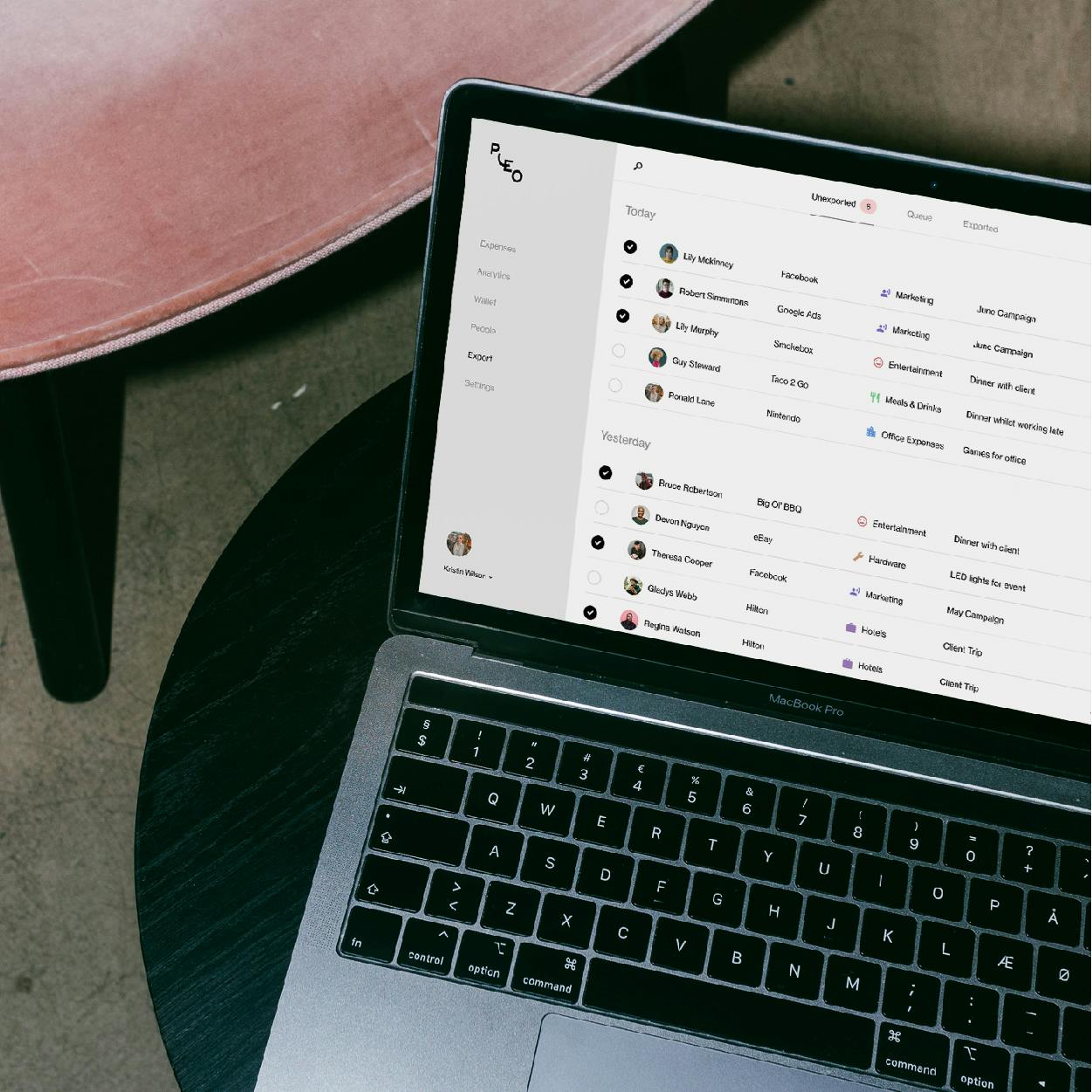

Your virtual card works the same way as a physical Pleo company card, but it’s stored in our app instead of in your wallet. Just log in and find your card’s details.

The spending tool you can rely on

Want to buy something online? Use your virtual card. Need to make a physical purchase? Just add your virtual card to Apple Pay or Google Pay.

Take charge of expenses immediately

Unlike physical cards, there’s no waiting period. In just a few seconds, you can issue a Pleo virtual card for business to anyone in the company that needs one.

Safe and secure purchases

Pleo’s virtual card for business comes with individual spending limits and real-time notifications for admins and managers. Freeze or disable cards if something doesn’t look right.

The virtual card built for business

There are a few reasons you might need a virtual business card, instead of relying on a plastic one.

Freelancers

A Pleo virtual card is a great spending solution for any freelancers and contractors your business uses. Just because they’re not part of your full-time team, doesn’t mean they don’t need to spend.

Once their contract is up, you can easily freeze or delete the virtual Pleo card, knowing all the expenses have been filed away and synced with your accounting software.One-off purchases

Not every work expense arises on a regular basis. Whether it’s a flight, a competition entry or seasonal decorations, some things only need to be paid for once.

A prepaid virtual debit card means you can empower your team to make that purchase with zero stress and no need to dip into their own pockets.Centralise project costs

It can be hard to forecast spend on big projects – and even harder to track costs once things are underway.

With Pleo’s virtual cards, all expenses are visible in real-time, in one place – so you can stay on top of the numbers. When the project wraps, just disable the virtual cards.

92%

of employees pay for business expenses with their own money

90%

of users are satisfied or very satisfied with Pleo

95%

of users feel that Pleo is easy to use

How virtual corporate cards keep your money safe

The rules around sharing card details have tightened up in recent years. But if that hasn’t inspired you to investigate new ways of managing spend, maybe the idea of keeping your money safe will.

Fraud losses on UK-issued cards totalled £620.6 million in 2019, with £470.2 million of that down to “card not present” transactions, according to UK Finance. Those are payments that are typically made online or over the phone.

When you bear that in mind, sharing bank details via email, text message or paper airplane probably doesn’t feel quite such a good idea. A corporate virtual card is a much smarter choice.

"Pleo has meant a massive shift in how much time from an average day is spent on strategy and not donkey work."

Sam Bradley Cookson Adventures

![Portrait of Sam Bradley and logo of Cookson Adventures]()

"No more chasing invoices here, there and everywhere. No more build-up of payments to be made."

Victoria Cozens Perky Blenders

![Portrait of employees from Perky Blenders]()

"I would recommend Pleo to every company that wants to save time."

Leonard Bergström Nordic Operations Manager, Budbee

![Portrait of Leonard Bergström and Budbee logo]()